No magic, no hocus pocus, just simple sacrifices. You’ve probably heard the magic fixes that are supposed to solve your debt problems immediately. What you don’t hear often enough are the people that lowered their debt through making personal sacrifices over a long period of time. This is the real way to lower your debt. The facts are there is no fast and easy way to make your debt disappear overnight. Instead, we focus on helping people use simple solutions over time to help them reduce their debt. Tactics like snowball payments and budgets are the only way to go as far as debt is concerned. While that option to declare bankruptcy in the near future might be tempting, just hold off and give these solutions a try.

Tips for Living a Minimalist Lifestyle

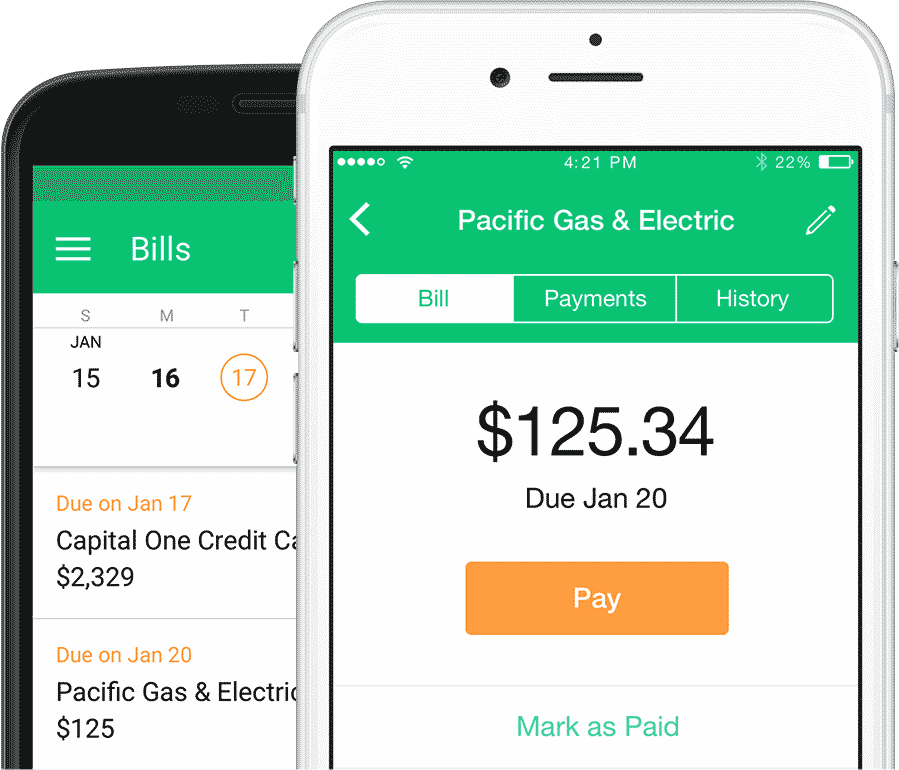

The following tips below are suggestions that assume you’ve already created a budget and spend every extra dollar towards paying off your debt. After bills, food, and debt, you need to get creative and stop spending money.

Live the minimalist lifestyle. This is a creative approach to spending. People often feel the need to buy and shop when they really don’t need to. A quick way to reduce and pay off debt is getting rid of everything you don’t need, including cable services, subscriptions of any kind, and downgrading your internet speed. Once your bills are lowered, you can start thinking of fun ways to stay entertained in your free time. If you really want some entertainment, the library is always free and in need of patrons!

Working from home is another great idea to help you pay off your debt early. You can use just a few spare hours during the week to earn some extra dough. You can then use that money exclusively for your debt.

Award programs are another great way to step up your game. Using discounts and completing surveys that pay out in gift cards can help you pay for groceries, gas, and anything else you can think up!

Working out naturally – There are plenty of ways to stay in shape without a gym membership. Going on hikes and jogging can be entertaining and get you ready for beach season.

The Essentials

I think you get the idea by now. Cutting debt is a lot easier than you think when you get rid of the things that don’t really matter. You can maintain a healthier lifestyle and save money at the same time. You just need to take into consideration what you need and what you just want.

0 Comments