Many people in the United States are constantly looking for new and better advice on ways to eliminate their debt. It can be scary at times to look at your account, especially if you can’t afford to pay your credit card bills on time. In all honestly, there is no magic trick that will wipe away your debt. Millions of Americans are living with it and learning to cope. There is, however, ways to slowly decrease your debt. In a reasonable amount of time you can become debt free. You just have to be a little wiser with your money. Below is a list of simple debt help tricks that will decrease your debt efficiently.

Debt Help: 5 Easy Tips to Reduce Your Debt

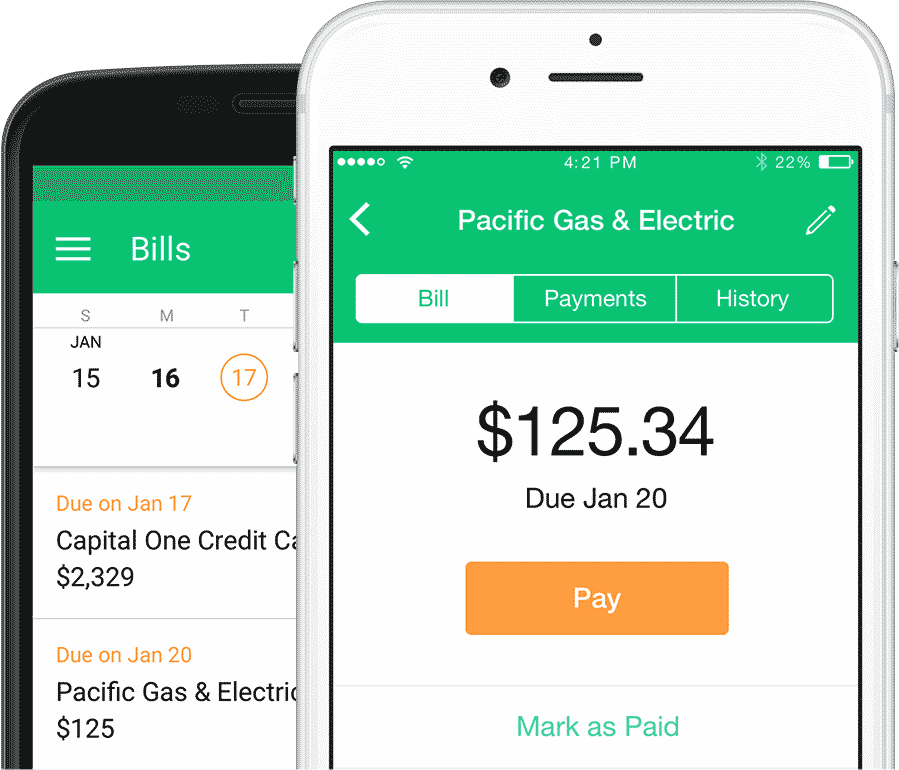

- Create a workable budget. You can see what your financial situation is and you know what affordable. The essentials come first (food, rent, bill, etc). The next important item will be decreasing your debt. A good rule of thumb is to pay at least twice the minimum balance. If you can’t afford this, you need to at least pay your bills on time. If you have any money left over you should probably allocate some to a savings account and the rest to general entertainment (movies, theatre, a good book, etc.). After all, what’s life without a little escapism?

- Build a safety net. This goes along with the above tip. Before you buy anything for yourself, like new clothes or even just a nice dinner, you need to start building a safety net in case something goes wrong. If you’re able to add to your savings month-by-month you can actually use this money down the line to help pay off your debt.

- Meeting with debt counselor is also beneficial. We’re not all born with the innate knowledge of money management nor do we know all the federal laws pertaining to our situation. Experts can guide you through the necessary steps to eventually eliminate your debt. They may even make you aware of laws and policies that could reduce your debt significantly.

- Know the difference between good and bad debt. For the most part, you need shelter, education, and a car to get you to work. Having a mortgage or students loans is debt that potentially increases your earning ability and improves your quality of life overall. Most anything else would be considered “bad debt”. You should weigh the pros and cons before maxing out your credit cards for that new computer or your dream vacation. While these things may seem intrinsically valuable, they will unnecessarily destroy your credit over time.

- Have good communication with your debtors. Many people envision scary business men that want to take your home away when you can’t pay your bills on time. The truth is quite the opposite. They want you to pay your bills just as badly as you do. In many cases, they will work with and help you create a new payment plan that works for you. You simply have to tell them why you’re having trouble coming up with the money and they’ll do everything in their power to help.

0 Comments