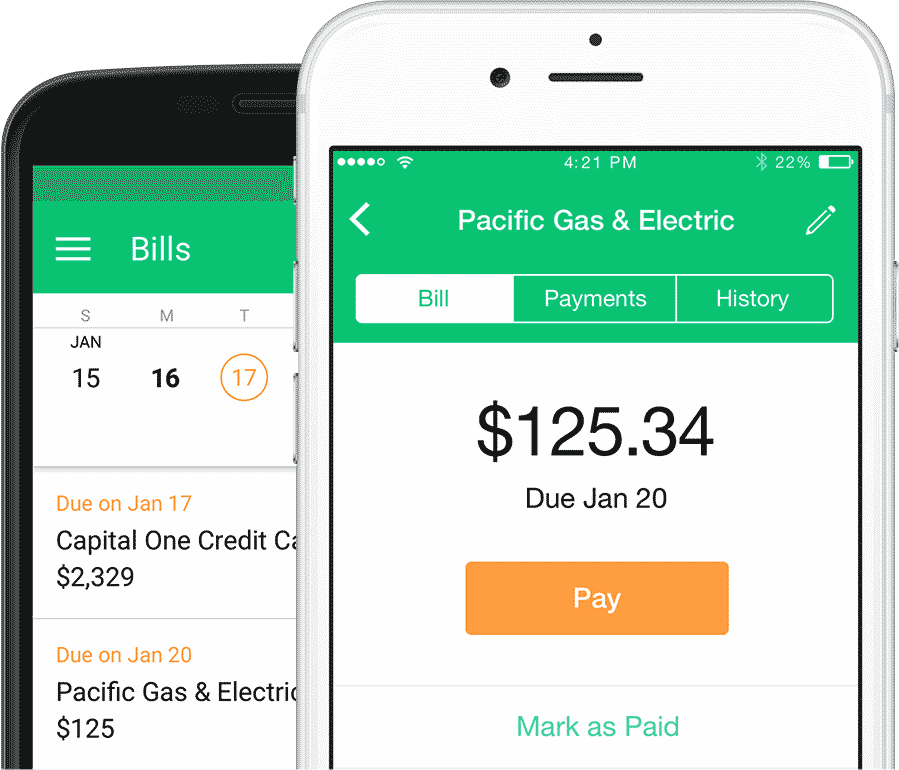

This trick requires some skill and precision to pull off. You essentially want to be at a point where you know 100% that you can pay off a bill in a certain matter of time. With all these elements added into the formula, you can use balance transfers to avoid some high-interest rates and use the money you save for other debts or keep it for your personal savings. As long as you plan everything out just right and follow the steps below, you should be able to avoid paying large interest fees on your credit card.

How Balance Transfers to Lower Debt Work

It’s best to create a picture in your head to follow along to. Let’s say you have a credit card with a high level of interest, 12% for this example.

Let’s say you also owe $5,600 on that card and will end up owing that card company $672 by the end of the month. Well, that’s not a great deal for you.

Now let’s say you receive an offer for zero-interest balance transfers with another card. Essentially, they will take control of your outstanding balance so you owe them instead. For a certain length of time, you can pay off your debt interest-free.

The important thing you have to consider is whether or not you can pay back the entirety of that balance in the time they specify your zero-interest period. Usually, if you can’t pay it back in time you’ll be hit with an even higher interest rate and end up owing more. Going back to the example, if you manage to pull this off correctly, you will have saved nearly $700 dollars and received more time to pay off your debt.

You can then take balance transfers a step further by applying the money you saved to other debts or you savings account to reach a better financial position and gain a cushion from becoming under debt again.

Reasons for using Balance Transfers to Lower Debt

- More time to pay off debt

- Save money from interest

- Easy to accomplish

0 Comments