If you’re suffering from lots of debt and see a company like Consumer Credit Counseling Service saying they can save you from debt that might be extremely appealing. You might also be wondering, “is the cost really worth it?” Well, yes and no.

You have to understand that these companies are not loaners. They do not give you money; they simply perform a service and expect to be paid for it. That being said, they do some pretty good work on their end.

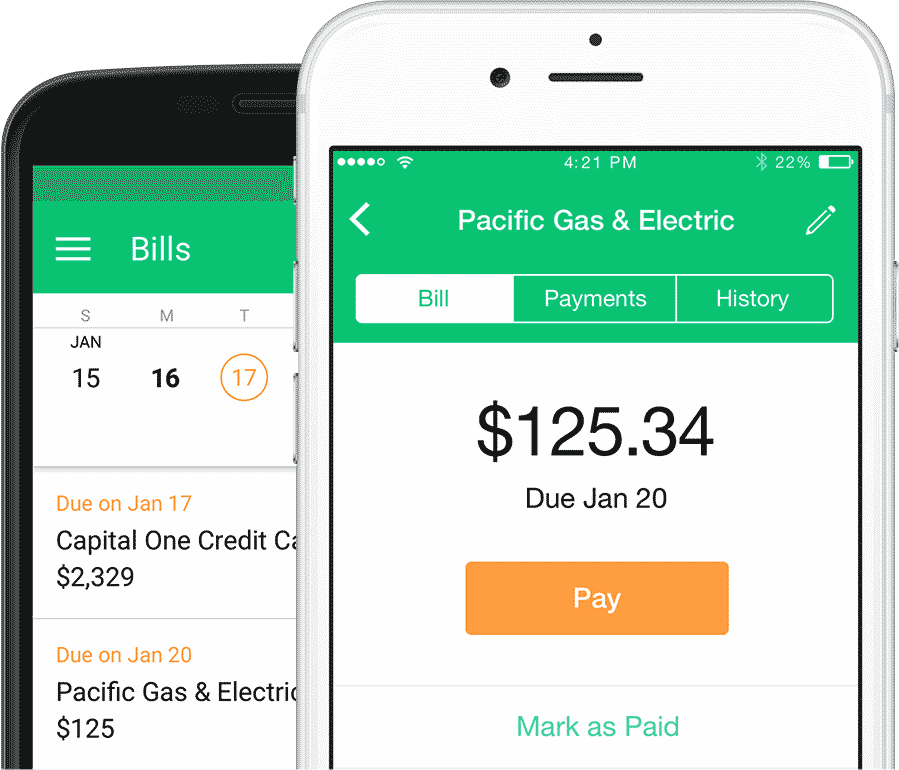

Their basic strategy is to take the money you pay them on a monthly basis and distribute that cash out to the people you owe money to. They might also negotiate a lower payment plan with the companies you owe if they are a good company.

That’s it, no magic, no ritual. That’s what they do. If you’re not impressed then you might want to consider using online resources to try it out for yourself. Their secret is they have no impulse to spend your money on things you don’t need.

They find the most efficient way to use your money and pay back your loans.

That being said, if you have the willpower to budget your money and save, then you can probably accomplish the same thing on your own and avoid paying them for their service.

Many people often confuse them for money lenders but that’s simply not the case.

The truth is you can probably handle it yourself. Given you have the drive and determination, you need only make a monthly budget and commit to paying off your debts one by one.

Choosing the snowball methods to pay off your small debts first and work your way up to the larger ones and finding new ways to save on your bills can be difficult.

By the end of your journey, you will likely have poor credit and no money but you’ll be out of the forest of debt and that’s a good foundation to build on.